Locating Insurance Carrier Information

Search methods include:

VIN only-

Required fields are VIN and Claim #.

Name and Address-

Required fields are Claim #, Last Name, First Name, Street Name, City, State

& Zip. For optimal results House #, SSN, Driver License # & State

should be populated.

Entering the date of loss greatly enhances the search results. After inputting the required information, click the "Report" button and you will see the Report Status. The results of the report ordered will display as one of the following:

- Complete

- Complete with Results

- Complete- No Hit

- Carrier Discovery Unavailable

Results Include: Carrier Name, AMB #, Policy #, Policy Type, NAIC #, Risk Type, Policy Inception Date, Policy Status, Policy Start Date, Policy End Date, Policy State, Last Cancel Reason, Subjects found on Policy, Current Policy Period Begin Date, Current Policy Period End Date, Cancellation Occurrences, Insured Vehicle Description, Vehicle Type, and Coverage Type.

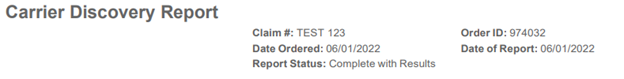

Order Section

The order section contains the basic identifying information regarding your report.

Claim # - Insurance company claim number that was entered in the search form.

Order ID - Identifying number for this order.

Reference # - Reference number for this report. Please have this number handy if you need to contact LexisNexis Customer Support.

Search Request Section

The Search Data Section provides a summary of the information submitted with the request.

DOL (Date of Loss) The date the accident was reported

SSN# - Social Security Number

DOB - Date of Birth

DL# - Driver License Number

State - The state that issued the Driver License

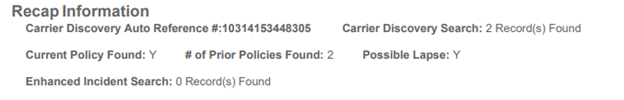

Recap Section

The Recap Section summarizes the information that appears in the rest of the report. It provides you with a Carrier Discovery reference number and/or a Claims Discovery reference number if applicable.

Carrier Discovery Reference Number - The fourteen-digit reference number assigned to the report.

Carrier Discovery Search - This is the result of the entire report. The following messages can be reported.

- RECORD(S) FOUND - Policy(ies) have been found and reported on the subjects or the VIN inquired.

- 0 RECORD(S) FOUND

- No policies were found for this inquiry.

If an error occurred while processing, one of the following messages will be reported: - INVALID ACCOUNT - The account number entered is not set up for Carrier Discovery.

- INSUFFICIENT DATA - Not enough data elements were on the inquiry to complete a Carrier Discovery search.

- CARRIER DISCOVERY UNAVAILABLE - The Carrier Discovery database is temporarily unavailable.

- ACCESS NOT

PERMITTED - The type of Carrier Discovery report (Auto) requested is not

permitted for the account number on the order.

If a DOL is submitted in the Search Request, you may see one of the following: - Record(s) Found DOL before inception date.

- Record(s) Found Not during DOL. CLICK HERE to reorder the Carrier Discovery report without the DOL.

Current Policy Found - A 'Y' for Yes or an 'N' for No will be reported. If 'Y', the inquiry date falls within one of the policy periods reported or the last reported policy period 'TO' date is within 30 days from the inquiry date. If 'N', the last reported policy period is greater than 30 days from the inquiry date or the previous policy period is within 30 days of the inquiry date but the policy status is reported as cancelled or the subject or VIN is reported as excluded on the current policy.

# of Prior Policies Found A prior Policy is an optional indicator that tells the ordering insurance carrier if Carrier Discovery registered a 'hit' on one of their own policies that is no longer in effect.

Possible Lapse: the first part reports if there was a lapse between policies for this subject. A 'Y' for Yes or an 'N' for No will be reported. If 'Y', the last reported policy 'TO' date is greater than 30 days from the inquiry date or multiple policies are reported and there is a gap in coverage between policies. The second part reports if there was a lapse in coverage while the subject was insured with a company.

Enhanced Incident Search: - This indicates if additional databases are searched. When Carrier Discovery Search yields no result, the system will search Claims Discovery and Accident Data. The following messages can be reported.

- Record(s) Found Claim/Accident record(s) have been found on the subjects or the VIN inquired by searched additional databases.

- 0 Record(s) Found No claim/accident were found for this inquiry.

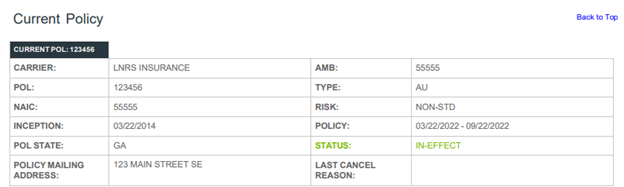

Policy History Section

The Policy Information section reports the current as well as prior (if applicable) insurance details.

CARRIER - Name of insurance company that reported the policy. A

>symbol will be reported before the carrier name if the policy was

contributed by the consumer, not the insurance company.

AMB - AM Best number from the insurance company. An 80000 will be reported if the policy was contributed by the consumer.

POL - The policy number reported by the insurance company.

TYPE - The type of policy held by the subject. Policy types include any of the following:

|

AU - Auto |

BO - Boat Owners |

CO - Condominium |

FL- Flood |

|

FR - Fire |

HL- Hail |

HO - Homeowners |

IM - Inland Marine |

|

MH - Mobile Home |

MO - Motorcycle |

QK - Quake |

RF - Ranch/Farm |

|

TN - Tenant |

UM - Umbrella |

WC - Watercraft |

XO - Other |

NAIC - National Association of Insurance Commissioner's number reported by the insurance company.

RISK - The type of risk for this policy reported by the insurance company. Each company has their own definition for each risk type. Risk type is a "contribute to play field," meaning your company must contribute this data field to receive this field from other contributors. Risk types include the following:

- STANDARD

- NON-STD (Non-standard risk)

- PREFERRED

- ASSIGNED

- FACILITY

- MIXED a mixed risk. For example, standard and non-standard risk is written under the same policy number)

INCEPTION - The effective date the policy was originally written.

STATUS - The most current status of the policy. Status reported includes:

- EXPIRED: Policy is no longer active.

- CANCELLED: The policy was terminated by either the insurance company or the insured.

- IN-EFFECT: Policy is active.

- DISPUTED: Consumer has disputed specific items or the entire policy.

POL STATE- A policy state code indicates the state which the policy was actually written.

POLICY START - The

date the policy started.

POLICY END - The date the policy ended.

LAST CANCEL REASON- A Cancellation Reason code indicates the reason which

the policy was most recently cancelled. If the policy is not cancelled,

LAST CANCEL REASON field will be empty.

|

COMP - Cancelled by company |

CUST - Customer request |

LAPS - Lapse/expiration |

|

MISR - Material Misrepresentation |

NONP - Non pay |

OTHR - Other |

|

RTCK - Return Check |

SOLD - Sold |

TRAN - Transfer |

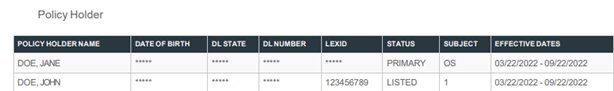

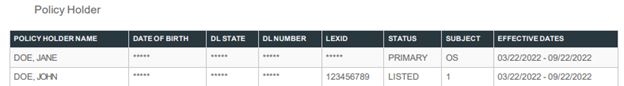

POLICYHOLDER- Names of each subject found on the policy. Subjects previously listed on the policy will also be reported. Following the subject's name is their last reported relationship to the policy. Relationship may be reported as follows:

- Primary- Primary policyholder.

- Listed- Secondary and other policyholders such as employees of the insured are reported as listed.

- Excluded- Reported by the insurance company as an excluded driver.

SUBJECT NUMBER- Corresponds with the order inquiry on which the subject was previously provided. An OS indicates the subject was found on the policy but was not included on the inquiry search.

FROM- The most current policy period begin date or the date the subject was added from the most current policy.

TO- The most

current policy period end date or the date the subject was cancelled from the

most current policy.

INSURED VEHICLE- Reports vehicles most recently covered on the policy. Also

included are the VIN, year and make of the vehicle.

BUS - If the vehicle was reported as being used for business a 'Y' will be reported. Otherwise, this field will be blank.

FROM- The most current policy period begin date or the date the VIN was added from the most current policy.

TO- The most current policy period end date or the date the VIN was cancelled from the most current policy.

NOTIFICATION- The date LexisNexis started counting the number of cancellation occurrences for the listed subject. This information will not be reported for subjects that were not part of the inquiry (OS).

VIN- The VIN of the insured vehicle.

Year and Model- The Year and Model of the insured vehicle.

COVERAGE- Types of coverage insured. Auto coverage types include:

|

BI- Bodily Injury |

MP- Medical Payments |

RR- Rental Reimbursement |

UP- Underinsured Motorist/PD |

|

CO- Collision |

NB- Uninsured Motorist/ BI |

TL- Towing & Labor |

OT- Other |

|

CP- Comprehensive |

NP- Uninsured Motorist/PD |

UB- Underinsured Motorist/BI |

|

|

CS- Combined Single BI/PD |

PD- Property Damage |

UM- Uninsured Motorist |

|

|

ME- Medical Expense |

PI- Personal Injury Protection |

UN- Underinsured Motorist |

|

Developed Incident History Section

This section(s) is present only when Carrier Discovery Search yields no results. The system searches additional databases (Claims Discovery and/or Accident Data) to retrieve information.

Loss Type: - The type of loss incurred as a result of the incident. Descriptions that may appear (from the Claims Discovery) in this field are:

- Bodily Injury

- Collision

- Comprehensive

- Glass

- Medical Expense

- Medical Payment

- Other

- Physical/Property Damage

Disposition: - This is the status of the vehicle for the loss listed. Descriptions that may appear in this field are:

- Repaired

- Stolen

- Totaled

- Damaged Other

- No Compensation

Disclaimer Section

The disclaimer section contains product proprietary information. In addition it explains how and where this Carrier Discovery Report was obtained and suggests the proper usage of the report.